What type of business growth do we need?

The perceived wisdom is that business growth is necessary as a fundamental driver to increasing the tax take that pays for our public services. But is this always the case?

Yes…In simple terms, it’s true. Increasing business growth usually results in larger profits. This then delivers increased corporate tax, dividends, increased wages and therefore, personal tax, increased goods and services tax (GST) and increased contributions to our Social Security fund.

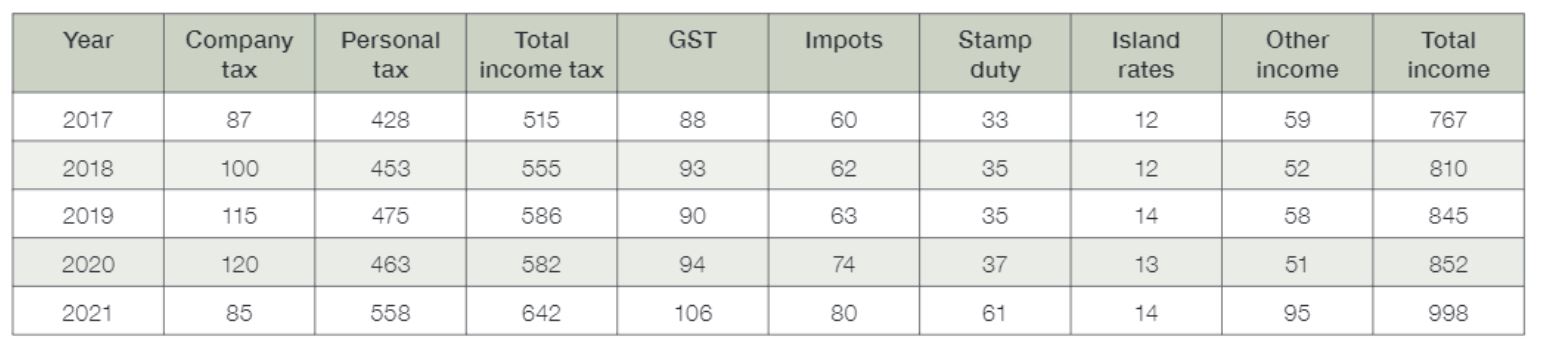

A quick look at the Statistics Jersey Income tax receipts report for the five years leading up to the Covid-19 pandemic shows how important business growth has been.

Notably, personal tax is the biggest income producer for the Island followed by company tax which together, in 2020, accounted for 68% and in 2021, 64% of the Government’s revenue.

As salary, dividends and company tax are generated through the performance of businesses, it’s easy to see why continued business growth is so important, especially given the magnitude of the contribution involved.

…and noHowever, a counterargument to this is that increasing business activity has resulted in a growing requirement to bring additional people to the Island. This has put pressure on our infrastructure, housing, and schools.

The simple economic answer is that we need growth, but also improved productivity so that we can generate more economic value from the same level of resource. This productivity challenge applies to both businesses, and to the provision of public services so that we get the best value and service from the income we generate.

Growth must be sustainableSustainable growth means finding a balance between our infrastructure, the impact on our environment, the general wellbeing of all our islanders and growth.

To achieve this balance, we need to have a better understanding of what I see as some of the more strategic challenges we face as an island economy that is dominated, in tax terms, by a very successful finance industry.

So, let’s tackle what many commentators describe as low productivity, particularly in the finance industry since 2008. What many don’t factor in is the impact of the UK’s interest rates during this period. This is a major driver in generating the profits of our banking sector and in reality, it is outside our control.

Higher interest rates will automatically increase profits in the banking sector. This is not because we have become more efficient, but because more interest is paid on the large cash balances held in our banks, thereby increasing taxable profits. This helps our tax take, but we really need to strip out this impact to truly understand how productive we are.

Another key factor to address is the concern many express over the negative impact that growth has on our need to bring additional labour on to the island. I would suggest however that the bigger issue is the risk of a declining workforce. For many small jurisdictions like Jersey, this is one of the biggest challenges faced because it is the working population that generate so much of the revenue that funds our public services.

Statistics Jersey’s ‘Population Projections’ show how our workforce would actually fall if we don’t continue to have net migration. Put simply, we are all living longer. The average age of our workforce is increasing, and Jersey has a real issue with what economists call the ‘dependency ratio’. Statistics Jersey forecast that if we have net nil migration over a 20-year period from 2015-2035 we will see a rise in the dependency ratio from 50% to more than 70%. This would mean we would be reliant on just 30% of our population to generate the personal taxation we need to fund our Island. This is simply unsustainable.

So yes, sustainable growth is good. Yes, we need to ensure we are all more productive, but equally we need a realistic plan for the long term to maintain the right size of workforce relative to the needs of our community.

This article first appeared in the Business Brief October 2022 edition.